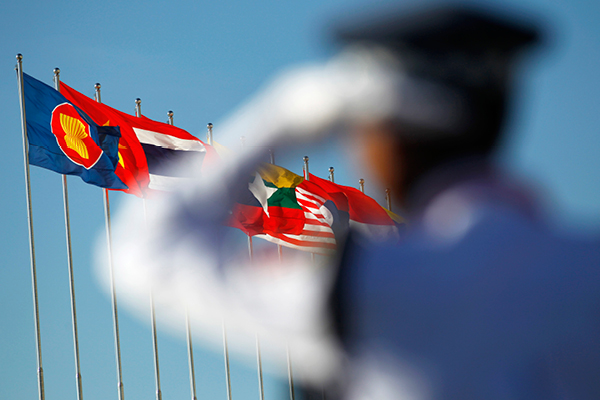

The ASEAN Economic Community, slated to come into existence at the end of the year, is expected to lead to a rise in cross-border trade and, as a result of that, more cross-border disputes. How are law firms and arbitration centres in larger markets like Singapore and Kuala Lumpur preparing for this? Ranajit Dam investigates

The Association of Southeast Asian Nations (ASEAN) will soon be celebrating a new landmark, with the implementation of the ASEAN Economic Community (AEC) due at the end of 2015. The AEC aims for a single market and production base allowing for the free movement, of goods, services, investment, capital and skilled labor; additionally, it aims to realize the development of a competition policy, the protection of intellectual property, the facilitation of e-commerce and the introduction of a more comprehensive investment protection and dispute resolution system.

By significantly promoting intra-ASEAN trade and investment and strengthening the global importance of the ASEAN as an economic block, the AEC is expected to give the whole region a significant economic shot in the arm.

“With a population of 620 million and a combined GDP of over USD 2.4 trillion, the AEC will stimulate consumerism and cross-border trade within the region as costs of trade within the member countries reduce gradually over the next five years. Businesses in the region will not see immediate rewards, but will eventually enjoy access to an ASEAN market with harmonized regional trade regulations,” says Raymond Mah, managing partner of Malaysia’s MahWengKwai & Associates.

The rise in the quantum of trade and investment, however, is likely to lead to disputes, and with the 10 ASEAN countries’ legal systems at various, disparate stages of development, arbitration looks set to be the dispute resolution mechanism of choice going forward. This means that law firms specialising in dispute resolution, as well as arbitration centres around the region can expect to feel the benefits.

Jonathan Choo, partner and head of arbitration and dispute resolution at Olswang Asia, says that the increase in trade “may very well translate to a corresponding uptick in the number of intra-ASEAN disputes, including investment disputes between investors and ASEAN member states. In that regard, the ASEAN Comprehensive Investment Agreement (ACIA) gives aggrieved investors the option to refer their disputes to arbitration if attempts at resolving their disputes through consultation have failed.”

According to Mah, these investor-state arbitrations are likely to increase as treaties are in place throughout the region aimed at protecting foreign investors in what are often construction industry disputes, creating a greater need for arbitration counsel with experience in these sorts of disputes. “Recently announced increases in investment into ASEAN-region infrastructure led by China and Japan are also likely to increase the need for more lawyers with a deep understanding of local construction sector dispute resolution,” he says.

With the increase in arbitration, the region’s arbitration centres are also growing in prominence. “One of the most positive trends has been that Asian arbitral centres are no longer just viable alternatives for ‘traditional’ seats in the West, but are becoming the first choice for parties,” says Datuk Sundra Rajoo, director of the Kuala Lumpur Regional Centre for Arbitration (KLRCA). “Institutional arbitration in Asia is also becoming quickly popular. Within KLRCA, there has been a steady increase in the number of cases that involve parties from the ASEAN territory. There also seems to be a trend in adopting multi-tiered dispute resolution clauses keeping in mind the increasing complexities and international legal issues involved in cross border transactions. Parties who opt for KLRCA also understand and appreciate the need for having an independent, neutral centre that provides cost effect international dispute resolution services.”

As a result, law firms in Southeast Asia also need to up their game. “For law firms, the liberalization of ASEAN legal markets, including Malaysia’s – which permits foreign lawyers to practice arbitration locally within specified parameters – increasing competition for local legal work,” says Mah. “In addition, the diversity of languages, legal regimes and venues for arbitration within and proximate to ASEAN member states creates a more complex environment for legal counsel to act on behalf of clients.”

Mah adds that MahWengKwai & Associates has been strengthening its arbitration and construction teams in preparation for these anticipated changes, and this year the firm formally launched its arbitration practice group in conjunction with its 30th anniversary.

Back to topMALAYSIA ASCENDANT

Poised to take advantage of this trend is Malaysia, and in particular the KLRCA. “The arrival of the AEC will therefore bring attention to and raise awareness of existing arbitration provisions in the ACIA,” says Rajoo. “The KLRCA is the key and only regional arbitration centre named in the ACIA, and with its combined ASEAN community presence and state of the art facilities is poised to provide specialist dispute resolution services throughout this new era of ASEAN growth. This is more relevant as KLRCA is the only arbitral institution in the region that has been set up under a host country agreement as a regional centre and as such was set up to cater to regional demands such as the cases arising out of the AEC.”

Rajoo says that key for the success of AEC is to have a regional, transparent, neutral, effective dispute resolution process that evokes the confidence of member states. “KLRCA with its recent and continuous initiatives including signing an updated collaboration agreement with ICSID and KLRCA on 20 November 2014 is not only prepared, but is also successful in tackling the increase in arbitrations. KLRCA’s award winning I-arbitration Rules provide for transactions involving Islamic finance, involving at least one Islamic party and non-Islamic counterparty(s). This is also extremely relevant in the ASEAN context.”

According to Mah, a key advantage is cost. “The falling ringgit makes everything in Malaysia affordable to foreign investors,” he says. “Additionally, the KLRCA’s fees are approximately 20 percent lower than Singapore and Hong Kong.”

He adds that the speed and durability of Malaysian arbitration awards provide advantages to parties. “For example, lengthy oral hearings can now be avoided in Malaysia with the application of the Fast Track Arbitration Rules introduced by the KLRCA which require disputes to be determined in short time frames of 90 days in documents-only arbitrations and 160 days in the case of oral hearings arbitrations,” Mah notes.

As a signatory to the 1958 New York Convention on the Recognition and Enforcement of foreign arbitral awards, arbitral awards granted in Malaysia can be granted within countries that are also signatories to the convention, notes Mah. “The Malaysian Government is currently in negotiations with the Permanent Court of Arbitration (PCA) in The Hague for the KLRCA to be appointed as an alternative venue in the region for arbitration, mediation and conciliation matters administered by the PCA. The government can and should work to see that this and other similar agreement are successfully reached as efforts like these will increase Malaysia’s attractiveness as a preferred hub of arbitration in the ASEAN region.”

Finally, he says that with the liberalisation of the country’s legal sector, foreign lawyers are now permitted to appear in arbitral proceedings in Malaysia, and they are exempt from paying withholding tax on fees earned.

Rajoo adds that another key advantage is that KLRCA is positioning itself not just as an international arbitration centre but as a true global leader providing all forms of ADR services. “Intra-ASEAN disputes, like other commercial disputes will also see the rise of multi-tiered dispute resolution clauses,” he says. “The complexities involved in these transactions are also constantly increasing and it is at this juncture that KLRCA being a full ADR service provider will prove most beneficial for parties. Further, KLRCA’s constant endeavours to promote co-operation with other International organisations ICSID will help balance its trend of regional expansion with international harmonization.”

Back to topSINGAPORE ADVANTAGES

Choo of Olswang says that over the last few years, he has seen a steady increase in the number of disputes between ASEANbased parties – in particular, parties based in Singapore, Malaysia and Thailand – that have ended up being arbitrated in Singapore. “This is not unexpected since parties have, over the years, become increasingly aware of the benefits of arbitration as a form of dispute resolution, particularly for cross-border disputes,” he notes. “Singapore has also positioned itself globally as a leading venue for arbitration and continues to attract disputes originating from a variety of sectors including construction, insurance, trade and technology.”

He notes that there are a number of advantages that the city-state has. “Singapore has developed a well-deserved reputation for being a neutral venue that is free of corruption,” he says. “Critically, there is also a strong judiciary in place that has developed a reputation for being non-interventionist when it comes to arbitration. Singapore has also been very successful in attracting a good number of high-quality arbitration practitioners, and this has contributed to businesses having better access to talented arbitrators and arbitration counsel based here.”

That said, Choo says that Singapore needs to remain nimble in order to ensure that it stays ahead of the game. “Our relevant legislation and rules will need to be tweaked from time to time in order to reflect current best practices and we would do well not to be afraid or slow to make those adjustments,” he adds. “There is also clearly a need to find ways to remain competitive in the face of increasing competition from other emerging, less expensive venues within ASEAN member states.”

Back to topGROWING AWARENESS

Despite the growing occurrence of disputes in the region, just how aware are local companies of arbitration and the benefits that it brings? Mah of MahWengKwai & Associates says that while many of the bigger companies doing business in the region are very astute when it comes to the risk of disputes, small and medium-sized enterprises (SMEs), who are the backbone of ASEAN countries have less knowledge when it comes to identifying and managing their legal risk. “However, as the ASEAN Economy Community brings greater and more complex economic activity, businesses would be wise to keep carefully abreast of legal developments in each of ASEAN’s 10 different jurisdictions,” he says. “Each jurisdiction within ASEAN possesses unique legal, regulatory and liability environments. Before seeking to enter or expand in any of these markets, businesses should first learn from local lawyers about the unique dispute risks each market represents and how best to manage those risks. The learning process does not have to involve a formal engagement, and can also include participation in arbitration conferences, forums and talks.”

According to Rajoo of the KLRCA, there is a definite steady increase in awareness amongst companies in the region. “In the ASEAN region especially, arbitral institutions have gained prominence,” he says. “In many ASEAN countries including Malaysia, arbitration has freed itself from the traditional role of Courts. The judiciary has turned complementary and supportive which promotes not just an ADR culture but more trust and harmonisation between the ASEAN member states. ADR culture will help promote harmonisation not just amongst companies and investors, but also nations. Here is where Institutions play an important role. KLRCA for instance takes its role as a think tank and knowledge repository to parties and stake holders constantly. Constant training programmes, seminars and other educational initiatives undertaken by the KLRCA is one such way to increase awareness amongst stake holders towards the availability and benefits of arbitration.”

Choo notes that he has seen a greater awareness among businesses in Singapore and the region, particularly over the last few years. “However, for most businesses, arbitration is still something that they are almost entirely unfamiliar with,” he says. “Many still confuse arbitration with mediation. I have had to explain to several of my clients what the difference is. More businesses need to aware of the significant advantages that arbitration has over other forms of dispute resolution. There are frequent courses conducted by the Law Society and institutes such as the Chartered Institute of Arbitrators (CIArb) which introduce businesses to the role and benefits of arbitration.”

Back to top