Cyril Amarchand Mangaldas and Simpson Thacher & Bartlett have advised private equity firm Blackstone on its $570 million acquisition of jewellery certification firm International Gemological Institute (IGI) from China's Fosun and IGI’s founding family, which were represented by Freshfields Bruckhaus Deringer.

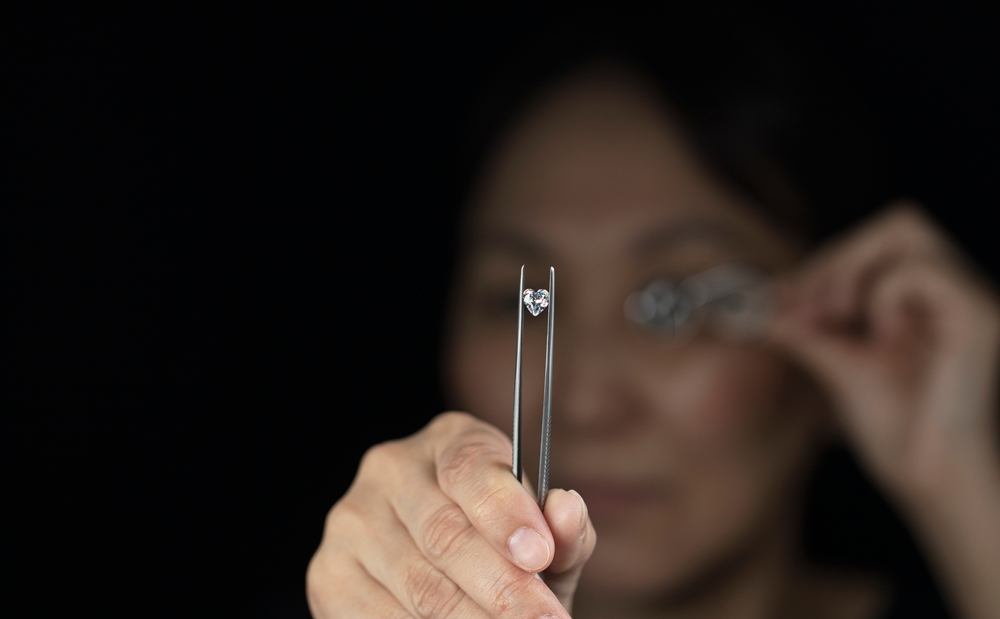

IGI, whose majority of revenue and profits come from India, was owned 80 percent by Fosun, and 20 percent by the founding family. Founded nearly 50 years ago by the late Marcel Lorie, IGI has 29 laboratories and 18 schools of gemology in 10 countries, with the majority of the laboratories being in India.

India’s jewellery market was worth $78.5 billion in the 2021 financial year, and it is one of the world's biggest, though a significant portion is for export, Reuters reported.

The CAM team included partners Shishir Vayttaden, Aditi Singhvi, Bishen Jeswant, Mudit Shah, Arun Prabhu and Avaantika Kakkar, while the Simpson Thacher team included partners Ian Ho, Erik Wang, Christopher Wong, Makiko Harunari, Lori Lesser, Jessica Cohen, Etienne Renaudeau and Leah Malone.

The Freshfields team was led by partner Edward Freeman, with Chinese law advice being provided by local firm RuiMin.