1. At A Glance

The Government of Indonesia has been focusing to boost public-private partnership infrastructure projects (“PPP Project(s)”) investment in Indonesia since the enactment of Presidential Regulation No. 38 of 2015 on Cooperation between Government and Business Entity in Infrastructure Provision (“PR 38/2015”). Referring to the Public-Private Partnerships: Infrastructure Projects Plan in Indonesia issued by Ministry of National Development Planning / National Development Planning Agency in 2018, the Government of Indonesia is preparing about fourteen projects in eight sectors.

The Government of Indonesia has taken major steps to increase the attractiveness of the PPP Projects and to support the private partner of PPP Projects, among others, by providing Viability Gap Funding (“VGF”) for PPP Projects. The latest regulation on this support is the Ministry of Finance Regulation No. 170/ PMK.08/2018 (“PMK 170/2018”) which came into effect on 21 December 2018 to amend Ministry of Finance Regulation No. 223/PMK.011/2012 (“PMK 223/2012”).

2. Understanding the Viability Gap Funding

VGF is support given by the Government of Indonesia, being the Ministry of Finance, in the form of financial, fiscal contribution given to a PPP Projects which use the ‘user-pays principle’ to improve its financial viability and effectivity. Part of state budget shall be given to PPP Projects in the form of cash to partially fund the construction costs of PPP Projects, provided that such funding shall not dominate the construction cost of the PPP Projects.

Further, PMK 170/2018 stipulates that VGF is given if there is no other alternative to make the PPP Projects is financially viable and is subject to a complete and comprehensive assessment by the Minister / Head of Institution / Regional Governor that the PPP Projects has the social interests and benefits.

3. Criteria

In order to receive VGF, a PPP Project shall meet the following criteria:

(a) the PPP Project is economically viable but is not yet financially viable;

(b) the PPP Project uses the ‘user pays principle’;

(c) the total investment cost of the PPP Project’s shall at least Rp100,000,000,000;

(d) the PPP Project is operated by a business entity established by the business entity which won the tender awarded by the government institution which is responsible for the PPP Project (Penanggung Jawab Proyek Kerja Sama / “PJPK”) by way of a publicly-open and competitive auction;

(e) the PPP Project is executed based on a public-private partnership contract which regulates the transfer of the assets and/or its operation from the private partner to the PJPK at the end of the PPP Project; and

(f) the PPP Project’s viability study result states that: (1) optimal risk sharing between the Government/PJPK and the private partner / tender winner; and (2) concludes that the PPP Project is economically viable; and (3) the project become financially viable after the provision of VGF.

4. Availability

The VGF may be given: (i) during the construction period of the PPP Project in accordance with the completion date agreed in the public-private partnership contract; and/or (ii) after the completion of the Commercial Operation Date of the PPP Project as agreed in the public-private partnership contract.

5. Key Points of PMK 170/2018

PMK 170/2018 has the following key points:

(a) the invoice for VGF is submitted by the private partner to PJPK while previously it was submitted to Proxy of Budget User (Kuasa Pengguna Anggaran / “KPA”), subject always to the agreed stages and terms under the Approval Document of Viability Support Granting (Dokumen Persetujuan Pemberian Dukungan Kelayakan);

(b) the documents enclosed with the invoice is simplified but the financial statement of the private partner is currently required;

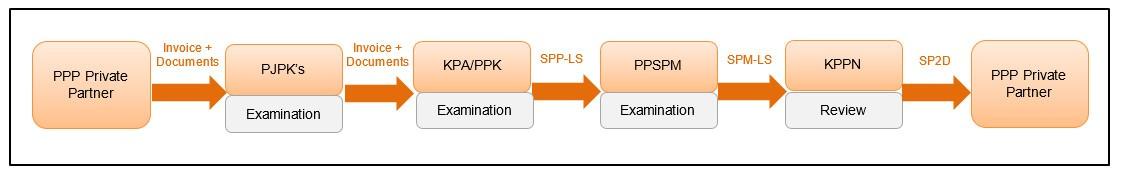

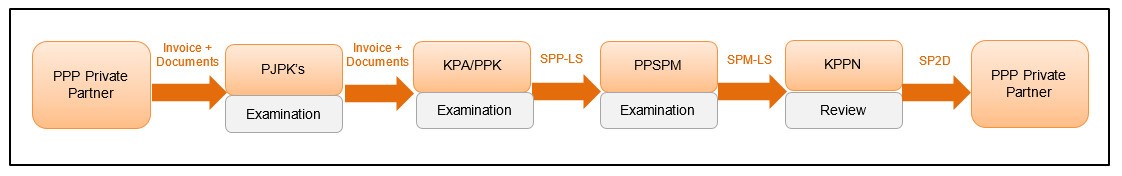

(c) examination of the completeness and correctness of the invoice document by the different authorities in multiple stages, starting from the PJPK, Proxy of Budget User (Kuasa Pengguna Anggaran), Commitment Making Officer (Pejabat Pembuat Komitmen), Payment Instruction Signatory Officer (Pejabat Penandatangan Surat Perintah Membayar) and State Treasury Office (Kantor Pelayanan Perbendaharaan Negara), with the following stages: